Starting December 2013, airlines ticket prices started going up steadily. This is understandable given that the holiday season is a lucrative time for airlines to make profits as demand outstrips supply by a huge margin. What was surprising was that the price of tickets for the non-holiday time period were also on an upward rise. For instance, the Bangalore-Delhi round trip which used to cost Rs 9,000-Rs 11,000 when booked 15-30 days in advance had risen and were costing Rs 15,000 for the month of February.

Now, suddenly, the 30-day advance booking fares have crashed to as low as Rs 8000 for a round trip between Bangalore-Delhi. This seems to be a great deal which no one would want to miss. But how do airlines benefit from such a scheme? On the surface, it seems that airlines will be making a loss with such schemes when they are already bleeding!

Here is why the scenario might be quite different.

The accounting behind the airfares: First, such schemes are being launched close to the financial year end. This scheme brings in huge liquidity in the form of cash for the airlines and makes theirs cash flow statements a bit healthier. The revenue is still considered unrecognized and shown as a liability in the balance sheet till the time a customer takes a flight. If subsequently, the ticket is cancelled by the traveler, then a minimum of 40% of the revenue will stay with the airline as cancellation fees for tickets.

The economics behind the airfares: Lets consider the Delhi-Bangalore sector. The regular advance fare on this sector is Rs 4500-Rs 4900. During the current schemes, the tickets are priced at Rs 3900. If the cost of capital for airlines is 16%, lets average it for half a year to keep it simple @8%,  the airlines would have paid Rs 312 as interest to get this revenue. Since no one is sure of plans 6 months in advance, lets say 15% of tickets are cancelled and 15% of the tickets are rescheduled. This brings in an additional Rs 474 (Rs 1580 as cancellation/change charges) per cancelled/ rescheduled ticket.

the airlines would have paid Rs 312 as interest to get this revenue. Since no one is sure of plans 6 months in advance, lets say 15% of tickets are cancelled and 15% of the tickets are rescheduled. This brings in an additional Rs 474 (Rs 1580 as cancellation/change charges) per cancelled/ rescheduled ticket.

Airlines do consider these cancellation/schedule changes and overbook tickets by a factor of 20% which brings in an additional Rs 780 per cancelled/ rescheduled ticket.

In reality, a seat which is being sold as Rs 3900 is actually bringing in Rs 5446 as revenue to airlines companies! That’s a fair bit more than the regular advance fares which used to be in the range of Rs 4500-Rs 4800.

So the discounted fares work well for airlines. It can be assumed that these schemes will be floated every year as otherwise operating cash flows will take a hit for airlines.

Does this mean that the consumer is being cheated? Not really. The fares are actually working more like insurance – you do get a cheap fare if you take the flight.

For travelers, the cost of capital is not more than 8%, which averages to Rs 156 for 6 months. So the total cost for the flight is only Rs 4050. The only catch is that the premium for this insurance is very high.

For travelers, the cost of capital is not more than 8%, which averages to Rs 156 for 6 months. So the total cost for the flight is only Rs 4050. The only catch is that the premium for this insurance is very high.

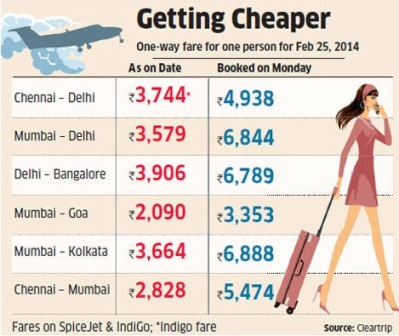

However, airlines have resorted to gimmicks to make this scheme attractive such as artificially inflating advance fares by 20-30% a month earlier. There has been no recent developments – fluctuations in aviation fuel costs etc, to justify this rise.

But is that reason to complain? I do not think so, as the scheme still works in the benefit of the customer. In addition, this adds to the load factor for airlines and brings in some new customers. These schemes also bring in a huge sum of cash as revenue and not borrowings which makes life easier for airlines.

For me, discounted airfares are a win-win strategy for both the consumer and the airlines.

Contributing blogger Alok Jain is a One year MBA (EPGP) candidate at Indian Institute of Management, Bangalore. Alok has close to 12 years experience working in IT services and products with organisations such as Amdocs, Sapient, Infosys and Jindal Steel & Power Ltd at numerous global locations. Besides an accomplished leader he is also an adventure sports enthusiast.